There are numerous differing types of trusts, Every single with its have special capabilities and Advantages. Here are some of the most common:

six. Train Money Obligation to the Next Generation Instructing fiscal literacy and accountability to Your kids and/or Other folks who might be portion of your respective wealth transfer approach is massively significant.

Retirement accounts are impressive applications for wealth creating and preservation because of their tax pros, progress likely, and legal protections. Listed here’s how they can enhance your wealth management prepare and aid to maintain your wealth:

Inflation can cause significant volatility and stock market declines; it isn't tough to see why. Inflation negatively impacts shoppers' buying energy and causes it to be dearer for people and organizations to borrow funds, so In addition, it results in lower demand from customers for houses, vehicles, and various massive buys.

Incapacity insurance is another potential Resource. Norwood states that, statistically speaking, persons are more likely to encounter a disability around their Doing the job yrs. Lots of individuals Use a disability just for a brief period of time, and cash flow alternative might be critical to protect wealth for the duration of that point.

It's important to Remember that a sixty/40 portfolio will assist you to hedge against inflation (and continue to keep you safer), but you'll likely be missing out on returns as compared to a portfolio with a greater share of stocks.

Instructing Your loved ones and family members about investments, wealth accumulation, and wealth preservation is critical to seeing The cash endure the next generation.

Without a will, your assets is going to be distributed according to your state's intestacy legislation, which may not align with your needs. This can lead to unintended implications and even relatives disputes.

Navigating inflationary markets demands each understanding and access to analytical applications. Such as, MarketBeat’s inventory screener might help detect inflation-pleasant investments, while financial advisors can give tailor-made guidance based on personal goals and chance tolerance.

It incorporates tax-productive strategies to minimize the impact of taxes on the wealth. This may require using tax free accounts, charitable offering, or other methods to lawfully reduce your tax legal responsibility and maintain additional of the wealth for Your loved ones.

Eventually, inflation can change the value of different assets in your portfolio, potentially throwing off your primary allocation. Stocks that prosper in inflationary periods may possibly outperform, though bonds or money holdings may well decrease in relative worth.

Without the appropriate documentation, You can not deduct your contributions out of your more helpful hints taxable cash flow for that 12 months.

In the event the business goes bankrupt, it might not be in the position to repay its debts, and bondholders would need to go ahead and take decline. To reduce this default risk, it is best to stick next page with purchasing bonds from companies with high credit score rankings.

That's what tends to make family wealth protection significant for guaranteeing financial safety and security for current and foreseeable future generations.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Tiffany Trump Then & Now!

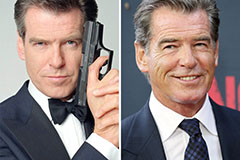

Tiffany Trump Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!